How to Use a Life Insurance Policy to Grow Your Business

Cash Value Life Insurance as a Business Financing Tool

Whole life or cash value life insurance is increasingly used by business owners as a pool of funds for future investment opportunities. Features such as comparatively higher financial returns than most treasury and money markets, liquidity access, and continued tax-exempt cash value growth combine to empower business and real estate owners to act as their own banker.

Using cash value life insurance as an investor tool doesn’t replace traditional business financing but complements it by adding another tool to the toolbox. There are no demands for repayment, so it offers entrepreneurs the flexibility of how, when, and even if they pay back the loan. They can suspend loan repayment when funds are tight, pay interest only, or accelerate repayment when flush with cash. They can also decide to not pay back the loan at all if the situation warrants, which we know wouldn’t happen if this were a bank.

As you’ll see in the examples below, it’s not talk up that cash value policy loans do not have to be repaid. There are consequences, but it’s a valid option if needed. It’s also not talk up that funds in whole life insurance are generally protected from creditors including business or personal bankruptcy. However, there may be exceptions in extreme situations and there’s an intermingling of federal and state laws. So, it’s important for business owners to consult with legal and tax experts in their state for guidance on tax and creditor protection.

How to Act as Your Own Business Banker

Business owners and entrepreneurs, by their nature, prefer as much control as possible to carry out their vision. By control, we mean the flexibility and independence to make their own business and financial decisions. Cash value life insurance offers entrepreneurs that financial independence. So, how can you act as your own business banker?

Perhaps you’ve heard about the Infinite Banking Concept (IBC) popularized in Nelson Nash’s 2000 book “Becoming Your Own Banker.” These concepts have been used by whole life insurance policyholders since WWII but gained widespread use after the book’s release. (Disclaimer: IBC Global has no affiliation with Infinite Banking Concepts, LLC).

We have plenty of content on how the IBC banker concept works in detail on our YouTube channel, but an overview is necessary to provide clarity to the example illustrations below. Essentially, the concept is to place funds into a whole life insurance policy and grow its cash value equity. When the policy reaches an equity position, the holder has access to funds as needed thereby acting as their own banker.

This concept offers several unique benefits for business owners that just aren’t available with other financial products.

10 Benefits of Business-Owned Whole Life Insurance

The financial benefits of cash value life insurance for corporations are vast as long as the policy remains compliant. Companies hold billions in Corporate-Owned Life Insurance (COLI) and Bank-Owned Life Insurance (BOLI) due to these financial benefits although they primarily fund future employee-related expenses. But they choose corporate whole life policies over all other funding mechanisms because of the unique combination of financial benefits and tax-exempt earnings.

- Long-Term Asset

Funds put into a business-owned whole life insurance policy are not classified as an expense and do not reduce profit. It’s a transfer of short-term cash to a long-term insurance-holding asset producing tax-exempt earnings.

- Tax-Exempt Earnings Growth

There are few, if any, financial products that offer tax-exempt earnings growth for business. Particularly ones that achieve a 3-5% return with built-in guarantees. With bank savings account and many government securities returning a fraction of a percent, a 3-5% yield is an attractive feature for business owners with long-term excess cash but desirous of keeping liquidity options open.

- Liquidity Options

For cash value life insurance to work as a business investor tool, it needs to be liquid. Once an equity position is realized then access to cash becomes available through policy or life insurance loans. Policy loans are used to keep cash proceeds tax-exempt. If funds are withdrawn from cash value equity, which is an option, interest and dividend earnings become taxable. Better a tax-exempt loan that technically doesn’t have to be repaid than a taxable withdrawal that reduces cash value earnings growth.

- Flexible Policy Loan Management

Flexible policy loan management provides business owners with independent control of their credit and finances. They can choose to make regular monthly payments, fluctuating repayment based on cash flow, or no repayment should a catastrophic financial event occur, or another lucrative business opportunity arise. Likewise, interest payment is also optional although serious consequences can arise in the future if the policy loan balance exceeds cash value equity.

Furthermore, there are no limits to the number of loans within a whole life insurance policy as long as borrowing is within cash value limitations. Policyholders can freely move funds into and out of the policy. Inflows can go into a Paid-Up Addition (PUA) rider to accelerate cash value growth or to debt retirement and policy loan outflows can be invested for financial returns.

- No Lost Earnings Opportunity Cost

Cash value earnings growth is not affected by life insurance loans. If a policy has $500,000 in cash value equity and a loan of $250,000 is taken by the business owner, then interest and dividend earnings accrue based on the full $500,000 cash value, not the $250,000 net. It’s a loan, not a withdrawal, so there is no impact on cash value earnings potential.

The reason for this is that the loan is secured or collateralized by a reduction in the death benefit and loan interest is charged by the insurance company. So, interest is charged on the $250,000 loan, but policy earnings are calculated on the full $500,000 in cash value equity. Furthermore, the return-on-investment on the $250,000 borrowed will offset interest expense in whole, or in part.

- Tax-Deductible Interest for Business

Interest charged on a policy loan should be a tax-deductible business expense in most cases as long as funds are used for business operations. It appears reasonable that if bank loan interest is tax deductible for business, then interest on an insurance policy loan should get similar treatment.

But it can only qualify if interest is paid out-of-pocket by the company because, like the policy loan itself, payment isn’t mandatory. If unpaid, it’ll continue to accrue increasing the loan balance and collateralized by death benefit reduction. But if it’s not paid, and because it may never be paid, it doesn’t qualify as a business expense. Only when interest payments are made do they potentially qualify for favorable tax treatment.

Regardless, the cash value equity in a whole life insurance policy can be used as collateral for bank financing thereby making interest tax deductible for business. Cash value assets used as collateral may also lead to lower borrowing costs.

Note 1: Although this appears to be a reasonable position to take, we are not tax experts and therefore strongly recommend consultation with appropriate tax professionals. We aim to educate, to communicate ideas, but we highly recommend readers follow up on due diligence fact-checking with subject-matter experts before making financial decisions.

Note 2: In addition to the possibility of a corporate tax deduction, we advise that interest payments be made on policy loans to not only avoid paying interest-on-interest, but also the potential for the serious complications of a policy lapse due to out-of-control loan growth.

We are certain, however, that death benefit disbursements to beneficiaries are currently tax exempt.

- Tax-Exempt Death Benefit

It’s difficult to think about our ultimate demise, but estate planning is part of life. As previously stated, the death benefit serves as collateral for life insurance loans. It’s reduced dollar-for-dollar by accumulated policy loans. If loans are not repaid upon death, beneficiaries receive the net amount as tax-exempt death benefits. Death benefits can also be used in business partnerships as buy-sell agreements where partners are listed as beneficiaries. Tax-exempt proceeds can then be used to purchase the former partner’s equity from heirs.

- Policy Loans are not Classified as Debt

Business-owned cash value life insurance holdings are a company asset. Therefore, policy loans are classified as an asset reduction, not as business debt. It’s generally a good idea to pay back the loan as cash flow dictates, but there’s no legal obligation to do so. And because they aren’t classified as corporate debt, life insurance loans for business do not impact debt or credit utilization ratios.

- Full or Partial Creditor Protection

Similar to planning for our eventual death, entrepreneurs are loathe to think about business failure and financial collapse. But asset protection is a useful financial planning tool to prevent destitution should the odds stack against us. The benefits of having funds in a whole life insurance policy for asset protection are threefold.

- The primary benefit is that funds in cash value life insurance are protected from creditors, in full or in part, in every state. That said, if the equity is legally assigned as collateral or otherwise, then it stands to reason that the lender has recourse.

- A secondary benefit is that policy loans don’t have to be repaid although death benefit payouts are reduced dollar-for-dollar. The insurance company issued the loan using the death benefit as collateral. They simply confiscate that collateral in lieu of payment and the policy remains in force if compliance is maintained.

- Which brings us to the third benefit. An intact whole life policy will pay guaranteed tax-exempt death benefits to heirs. It’ll be reduced if loans are outstanding, but the remainder is guaranteed. That type of peace-of-mind is priceless.

Of course, it’s important to consult with a commercial lawyer to get a formal legal opinion on insurance-related business creditor protection laws in your state.

- Flexible Policy Design

The increasing popularity of whole life insurance as a business and real estate investor tool is due to policy design flexibility. The ability to design a policy for maximum cash value growth is critical to its value as a business investment tool. A traditional whole life insurance policy may take up to 15 years to reach an equity position because of poor design. That type of policy design negates its potential as an investor tool.

As you’ll see in the examples below, we design policies that achieve an equity position in as little as three years, rather than 10 or 15 years. Even three years seems like a long time to wait before using it as a business financing tool. But sustainable business planning takes a long view and once an equity position is reached in a few years, entrepreneurs gain an onslaught of financial benefits that lasts for decades.

Optimal Policy Design for Financial Growth

The examples below illustrate how to design a whole life insurance policy for one purpose - maximum cash value growth. We’re not adding any chronic or long-term care riders that many consumers prefer but are a drag on cash value growth potential. This policy design is built for the performance required to efficiently serve as a business funding mechanism. Even the death benefit is secondary.

To design a high-performance cash value life insurance policy, we need to properly allocate incoming funds between the insurance premium portion and Paid-Up Additions (PUA) rider.

The premium, of course, covers insurance company expenses and funds the death benefit. The insurance company front-end loads the premium allocation by overcharging in the first two years. Hence, the three-year span until cash value equity is achieved. This will become clearer as we go. If it were a BOLI, we could reach equity in the first year, but we have to play by the rules given.

The PUA rider is where the magic happens. It determines cash value growth potential. Essentially, we want to allocate as much as allowable to the PUA. The rules for PUA allocation vary between insurance carriers so choosing the right company also factors into financial performance.

We’ve tested insurance companies over several years to see how far we could push the PUA allocation to boost performance. We found that companies that allow the highest PUA allocation also tend to have the highest historical financial returns and the quickest path to an equity position. The faster we get to cash value equity, the sooner it serves as a business funding and financing tool.

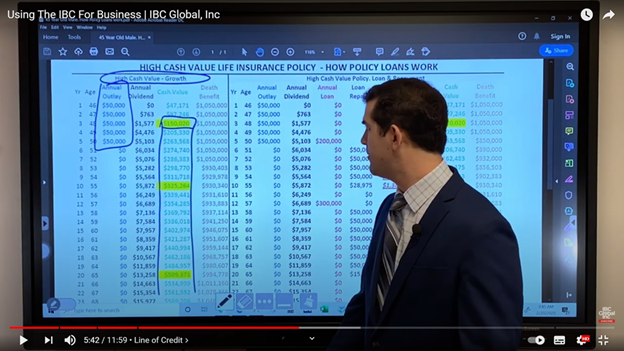

To the left of the screenshot below is an illustration of a pure high cash value life insurance policy. It’s designed for performance and the policyholder isn’t taking out policy loans. Paid-in capital is $50,000 per year with a five-year funding plan. Whole life insurance premiums do not have to be paid ad infinitum. A business can fund the program initially, suspend payment, and let cash value grow.

Notice that cash value breakeven or an equity position was reached in the 3rd year with $150,000 paid-in and $150,020 in cash value. The policyholder now has the option of taking policy loans for business initiatives as we’ll see in the next illustration.

Cash Value Business Investment Financing

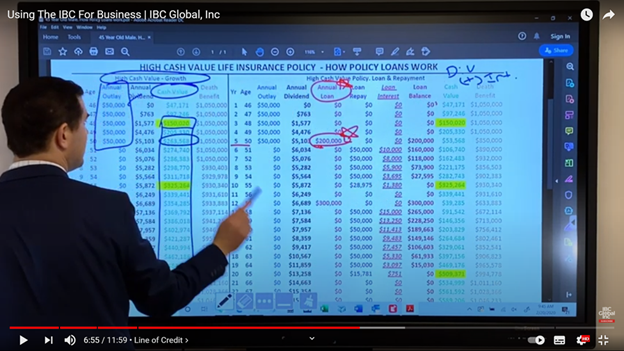

To the right of the illustration below, we have the same performance-enhance policy design which the policyholder is using as a business investment funding and financing tool. Using the “become your own business banker” strategy, we fund our bank, let cash value grow, and then borrow from it as needed.

Let’s assume that the company 5-year business plan calls for expansion to a new location and $200,000 will be needed for start-up costs. The business owner funds the policy at $50,000 per year earning a 6% return annually. It’s the same policy design so cash value equity occurs in the third year, grows another two years, with the entrepreneur exercising the policy loan option in the 5th year for $200,000.

Rather than waiting five years and financing the expansion with traditional financing, the owner chooses to pre-fund the expansion using a cash value life insurance policy that grows at 6% per year. There are plenty of funding options and with higher annual yields, but the owner wanted the highest possible return, preferably with guarantees, and the lowest risk of loss.

In terms of risk, Treasury notes are often deemed the gold-standard of safe financial products. Whole life insurance isn’t far behind and both are commonly used in risk hedge strategies. We typically estimate current cash value returns for new policyholders at between 3-5% compared to 10-year Treasury notes at roughly 1.5% and 30-year notes returning around 2.3%.

So, a $200,000 policy loan is taken in the 5th year. Notice the impact of the loan on Cash Value and Death Benefits between years four and five. Cash value decreased by $151,762 which represents the $200,000 loan outflow minus the $50,000 of paid-in capital plus $1,762 interest expense. Comparatively, 5th year cash value in the first illustration sits at $263,568.

The death benefit is used to collateralize the loan and decreases by exactly $200,000 to $850,000. We’ve assumed loan interest of 5% and that’s annual simple interest, not compound. Repayment is $50,000 annually for four years with a final payment in the 5th year.

Keep in mind that although cash value equity shows a balance of $53,568, annual earnings are based on $253,568 as if the $200,000 policy loan were never taken. If we scroll down to full loan repayment in year 10, you’ll notice that Cash Values highlighted on both left and right are identical at $325,264. Whole life insurance loans do not impact cash value returns. They are addressed as separate transactions.

To clarify cash value earnings, it may be helpful to think in terms of financing home ownership. Let’s assume a home is valued at $1 million appreciating at 5% annually and has an $800,000 mortgage. Property appreciation (cash value growth) of 5% grows from the base value of $1 million and interest is charged on the $800,000 mortgage (policy loan). The mortgage has no impact on property value appreciation just as a policy loan has no impact on cash value growth.

The final item to be aware of in this illustration is loan interest expense of $28,975. Interest is paid to the insurance company. It’s an actual expense. There are false statements circulating that interest is paid to the whole life insurance policyholder. This takes the act as your own banker concept into the absurd. It would be redundant to both pay and collect 5% interest on a life insurance loan. If you come across this advice, particularly from an agent, run.

In Part II, we’re financing equipment replacement.

Financing Equipment Replacement

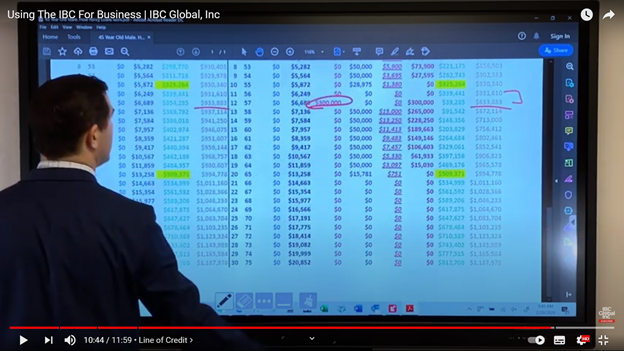

In this scenario we’re using our business financing tool to replace $300,000 of vitally important equipment. It could be production equipment, an IT upgrade, or delivery vehicles. Recall that year 10 cash value was $325,264 after loan repayment. Also recall that we stopped funding the cash value life insurance policy after the 5th year for a total pay-in of $250,000. We now take out a policy loan of $300,000 to cover the purchase in year 12.

It’s not necessary to repay a previous loan to take out a new one. A business owner can float several loans as long as they remain compliant with policy limitations.

Let’s quickly hit the high notes from Part I. Compare 12th year cash values and death benefits for the two scenarios and note changes. Continue to compare while scrolling to year 20 when the loan is repaid and balances are fully restored as if the loan was never taken.

Wrapping Up Loose Ends

Cash value life insurance can be an effective tool to fund and self-finance long-term business initiatives. Financial returns are often comparatively higher than similar low-risk investment options and liquid access through policy loans only sweeten the deal.

The ability to write off the interest expense on policy loans is not sufficiently clear to us. So, two questions, among others, for your financial team are, “is interest expense within a whole life policy a deductible business expense?” And “if not, is it deductible if we use cash value equity as collateral for creditor financing outside of the policy?”

Other important considerations include the legal structure of a whole life insurance within your business. Is the policy in the company’s name or an individual? Who are death benefit recipients? What happens to remaining cash value if the company is sold or upon the business owner’s retirement? Can it be taken as a retirement annuity by the owner?

We’ve covered a lot of material and hopefully it’s provided the information needed to make further inquiries on how cash value life insurance can be used to fund and finance long-term initiatives yet also serve as an emergency cash reserve should an urgent situation arise.

Flexible Tax-Free Business Financing Tool

Maximum cash value whole life insurance policies are flexible tax-free savings vehicles. Cash value funds can be used in emergency situations, used as tax-free loans, and act as an annuity during your retirement years. It can be particularly useful for those who’ve maxed their IRA and 401k limits by providing a safe, stable, tax-free investment.

If you’d like more information on how to use a whole life insurance policy to maximize your tax-free cash position, you can view instructional videos on the IBC Global YouTube channel. You can also contact us for a free, no-obligation consultation from one of our Innovative Life Insurance Specialists.

Disclaimer

IBC Global Inc is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.

.png)