Are People Aged 60-69 Too Old for Whole Life Insurance?

Are People Aged 60-69 Too Old for Whole Life Insurance?

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” Warren Buffett

Although we lose the advantage of long-term compound growth, we can still design a whole life insurance policy for 60-year-olds that results in high early cash value growth in the near- to mid-term. In the near-term, we can typically design a cash value life insurance policy to reach breakeven in 3-5 years for healthy 60- to 69-year-olds.

The key to making whole life insurance advantageous to the 60 to 69-year-old demographic is strategic policy design. Traditional and off-the-shelf whole life cash value insurance are not going to get the job done within a reasonable timeframe. Strategic whole life policy design is critical to high early cash value growth as illustrated below.

This article covers:

- Typical Reasons 60- to 69-year-olds Choose Whole Life Insurance

- Whole Life Policy Design for Fast Cash Value Growth at any Age

- The Most Efficient Policy Design for a 60-Year-Old to Transfer $1 million?

- Death Benefits, MEC Limits, Term Insurance, & Reduced Paid-Up (RPU)

- Dividend Rates do not Equal Financial Returns

Multiple Advantages of Whole Life to Those in Their 60s

Roughly 1 in 5 males and 1 in 3 females that reach 65-years-old will live until age 90, according to a probability analysis by the Hamilton Project. The CDC estimates that a healthy 65-year-old has an average life expectancy of around 20 more years or 85-years-old.

There’s a lot of life left for the average person in their sixties and particularly so for those that prioritize healthy living. That means those in their 60s still have time to leverage a cash value life insurance policy, but for slightly different reasons than those in their 30s.

Typical reasons 60- to 69-year-olds choose whole life insurance:

Wealth Preservation – they don’t want to lose what took a lifetime to build. Whether it’s to protect a financial legacy for heirs, create another retirement income stream, establish a personal or family bank, or put a little more aside in case you win the longevity sweepstakes, cash value life insurance has the policy design flexibility to make it happen.

Safety – cash value whole life insurance is one of the safest places to position cash in good economic times and bad. Banks hold billions of dollars in whole life insurance assets to meet their tier-1 core capital regulatory requirements. The wealthy deposit funds into cash value life insurance to diversify financial holdings as a hedge against market risk. And to take advantage of the tax-exempt estate transfer feature paid to heirs as death benefits.

Flexibility – whole life insurance offers an array of policy rider options that can be blended or customized to the policyholder’s wants and needs. Term insurance can be purchased to boost death benefit coverage to optimize cash value growth. Hybrid whole life insurance policies combines cash value growth and long-term care coverage. Chronic and terminal illness can be covered through an accelerated death benefit rider that allows access to cash value savings should long-term or terminal illness strike.

Creditor protection – cash value savings within a whole life insurance policy enjoy greater creditor protection than most alternatives. Always get a qualified legal opinion on these matters due to the complex web of federal and state laws but generally speaking whole life insurance values are protected to some extent in all 50 states.

Tax-exempt – cash value life insurance offers comparably higher after-tax returns than other safe financial products in their asset class like T-bills, CDs, and high interest savings accounts. Tax-exempt status extends to the guaranteed death benefit which serves as a tax-free estate transfer.

Liquidity – cash value savings are similar to traditional savings accounts but typically earn higher interest. Moreover, cash value savings can be quickly accessed if needed either through a tax-exempt withdrawal or insurance company loan.

This unique combination of features available in a permanent whole life insurance policy, unmatched in any single financial instrument, positions it as a potentially valuable wealth preservation, retirement, and estate planning tool for 50 –, 60 –, and 70--year-olds.

Policy Design for Fast Cash Value Growth at any Age

The benefits of cash value life insurance shift as we grow older. Financial planners typically advise us to transfer cash assets from higher- to lower-risk options as we grow older to lock in and protect long-term financial gains. So, we shift our financial strategy from wealth accumulation to wealth preservation as a hedge against economic and market volatility. MassMutual personal finance writer Shelley Gigante describes this financial life stage as entering the wealth transfer zone.

We often hear from older individuals that they were presented with whole life insurance in their younger years but that cash value breakeven took around 12 years. So, they chose to put their money toward financial assets that offered faster returns. I get it. I’d do the same thing if presented with a 12-year cash value breakeven and negative yield timeline. But as you can see below, we can hit that breakeven point in as little as 3 to 5 years with a strategically designed permanent cash value life insurance policy.

For example, a 10/90 split ratio allocates 10% of paid-in funds to the base premium for life insurance coverage (death benefit) and 90% into the Paid-Up Additions (PUA) component to accelerate cash value savings growth. Identical split ratios result in similar early cash value growth trajectories regardless of age. Death benefits, however, vary greatly by age but are secondary to cash value savings growth for those at advanced age.

Beware the Price Quote if Cash Value is Priority

There are two basic components to a whole life insurance policy. One is the price quote which determines death benefit coverage. This is what you see on life insurance affiliate sites where they ask general questions like age, health, etc. and spit out a premium. These sites are okay for those in their 60s looking for whole life insurance to cover funeral expenses.

But if you’re looking to take advantage of its cash value planning and savings component, then getting a price quote is not the way to go. Price quotes are based on a fixed actuarial algorithm whereas cash value planning blends all whole life features into an optimized financial strategy. It’s important to speak to an agent when contemplating using cash value life insurance as a financial strategy to ensure an appropriately designed policy.

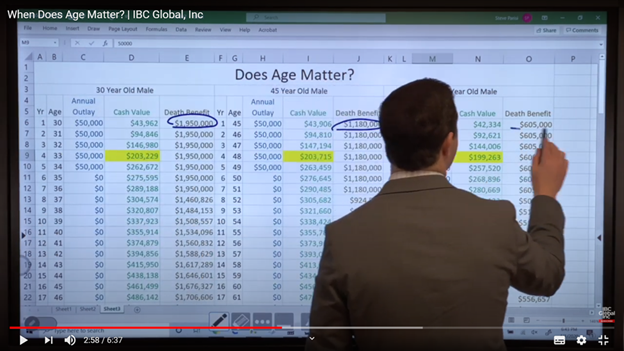

Let’s get a visual on how this works. Below we illustrate high early cash value growth for three whole life insurance scenarios. To the left, we have a 30-year-old male, in the center of 45-year-old male, and to the right is 65-year-old male.

The three policies are funded with a $50,000 annual outlay for a period of five years. (Five years is just for illustration purposes we can fund cash value policies for shorter or longer duration depending on your goals and financial situation). But what we want to focus on here is the same cash flow going in, for the same duration, and with the same policy design.

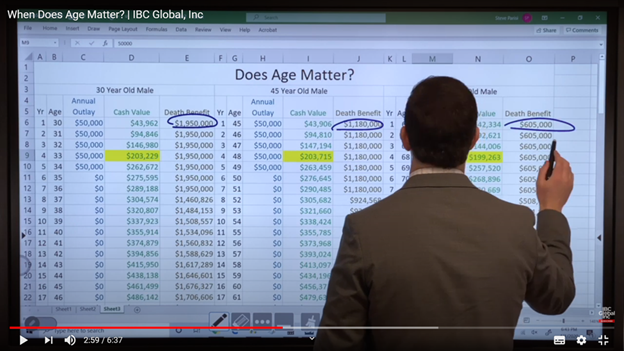

Notice the similarities in cash value columns in the first year. Cash value savings for the:

- 30-year-old is $43,962

- 45-year-old is $43,906

- 65-year-old is $42,334

Internal insurance expenses are a bit more for the 65-year-old due to the higher cost of the term insurance rider required for a $50,000 MEC limit. Life insurance becomes more costly as we age, so younger policyholders typically have lower costs.

So, in year one cash value equity is 85% to 88% of paid-in capital plus a sizable death benefit in all three scenarios. Furthermore, cash value breakeven is uniformly achieved in the fourth year although the dollar amounts differ slightly. So, at this point, cumulative paid-in capital is sitting in the policyholder’s cash value savings account, and each has a sizable death benefit ranging from 6 to 7 figures.

Notice the significant variation in death benefits among the three scenarios:

- The 30-year-old has a first-year death benefit of $1,950,000

- the 45-year-old has a first-year death benefit of $1,180,000

- the 65-year-old has a first-year death benefit of $605,000

So, it’s death benefits that vary widely by age not early cash value savings recapture which is why whole life insurance serves as a wealth preservation tool for those at advanced age. We go into greater detail on the death benefit variation in the Death Benefits, MEC limits, Term Insurance, and Reduced Paid-Up (RPU) section below.

The takeaway to this point is that permanent whole life insurance policyholders don’t have to sit in financial purgatory for 10 to 14 years waiting for cash value breakeven. It can take that long with a poorly designed or traditional whole life policy, but a strategic, high performance policy design can generally get there in under five years. Moreover, it illustrates that even an advanced age, a 65-year-old can still create a six-figure financial legacy for heirs more if they have the funds to transfer.

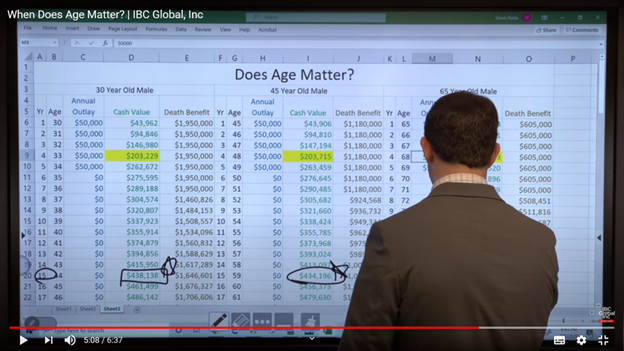

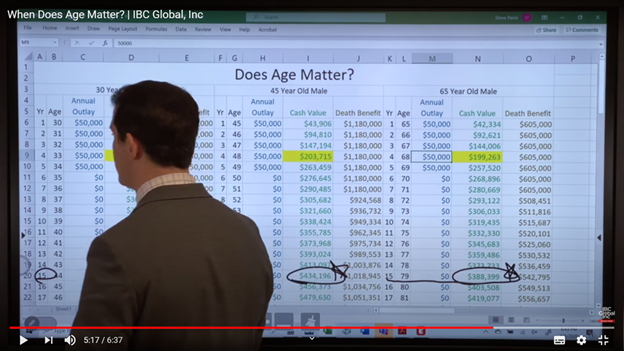

Of course, the younger you get started, the better the results are going to be. If you look at year 15 for each of the policies, the guy that started at age 30 has cash value of $438,000 and for the 45-year-old $434,196. Not a big difference.

The 65-year-old, now aged 80, has $388,399 in cash value savings after 15 years. Although at a more advanced age, the 65-year-old still reaches a 15-year cash value within $50,000 of his younger counterparts.

So, very similar cash value savings trajectories in the early going regardless of the age of the policyholder. Cash values start to diverge in the midterm and long-term growth favors the young. But 60-year-olds are only concerned with the near- and mid-term in relation to lifespan, not the long-term.

What’s the Most Efficient Policy Design for a 60-Year-Old?

In our next vignette, we illustrate how different policy design funding models affect cash value savings growth. The client had a great question which was “can I just write a ($1 million) check to fund the policy and be done with it?” Technically, yes. However, it’s not the most efficient funding model for triggering accelerated cash value growth.

This 60-year-old real estate investor has entered the wealth transfer stage of retirement and estate planning. He wants to transfer $1 million to a cash value whole life insurance policy for safekeeping and to act as a personal real estate bank and credit facility.

In this way, he locks in lifetime investment gains, enjoys greater financial protection in an uncertain economy, sets up a financial legacy for heirs, and yet still retains liquidity should an attractive real estate opportunity arise. Let’s take a look:

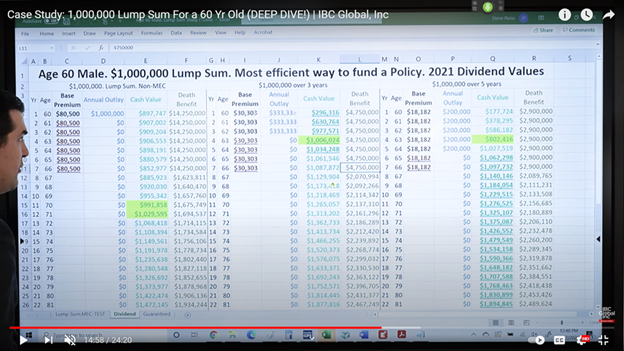

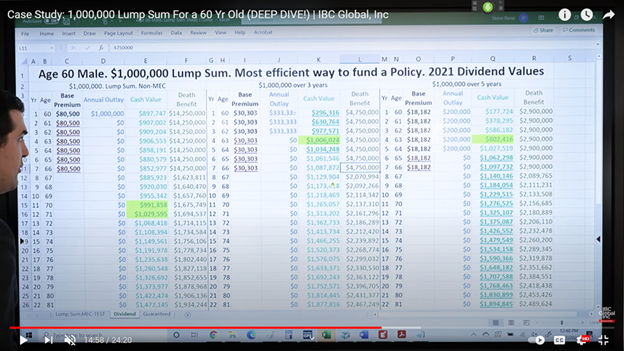

Below, we illustrate three scenarios for transferring $1 million into whole life insurance to find the most efficient funding model. By efficient, we mean the best model to optimize high early cash value savings growth for a 60-year-old.

Scenario 1 – lump sum funding of $1 million in the first year.

Scenario 2 – spread over a 3-pay funding model at $333,333 per year.

Scenario 3 – spread over a 5-pay funding model at $200,000 per year.

Whole Life Insurance Cash Value Highlights

Funding Model (000)

Year LS CV 3-Pay CV 5-Pay CV Age

(1) % (2) % (3) %

1 $898 90% $296 90% $177 90% 60

4 $907 91% $1,006 100% $802 100% 63

8 – RPU $886 89% $1,130 113% $1,140 114% 67

12 $1,030 100% $1,313 131% $1,325 133% 71

20 $1,374 137% $1,753 175% $1,768 177% 80

Year 1 – all funding models reach cash value equity at 90% of paid-in capital. This cash is now accessible to policyholders through insurance loans in strategically designed policies. Some cash value life insurance policies have loan limitations in the early years particularly fixed policy design products. So, it’s important to tell the agent at the policy design phase if early liquid access to policy loans is desired, for example, when implementing a banking strategy.

Year 4 – Scenarios 2 and 3 reach cash value breakeven albeit at different dollar amounts. These policyholders can now rest easy that 100% of their hard-won cash savings are secure and earning interest. Cash value equity in Scenario 1 is still languishing at 90 to 91% of paid-in capital.

Scenario 2 has the fastest cash value growth to this point and Scenario 1 is second because they’re fully funded at $1 million. Scenario 3 looks like the tortoise to two hares, but still has a $200,000 contribution to make. The 3rd scenario takes the lead in the 6th year after being fully funded at $1 million.

Year 8 – the 7-pay MEC test period expires, and all policies are fully funded at $1 million. So, we exercise a Reduced Paid-Up option to stop premium payments and set up a fully paid for death benefit. To this point, the 5-pay funding model on the right has generated the highest return on paid-in capital.

Year 12 – Scenario 1 finally breaks even at $1.03 million. The 3-pay funding model has generated an additional $283,000 in cash value equity and the 5-pay model is $295,000 higher than Scenario 1. So, nearly a $300,000 swing in 12 years just from the funding model designed into the policy. That’s huge!

So, all other values being equal, we see that the initial funding model design is critical to optimizing high early cash value savings growth for those in their 60s, or any age for that matter.

Another important observation is that 60-year-olds can still leave a significant financial legacy in the form of death benefits by transferring cash assets into whole life insurance. Furthermore, if the policyholder wanted to draw a retirement income at age 70, they could do so tax-free up to the paid-in capital. For example, this policyholder, for example, could take the $229,515 (any amount up to $1 million paid in) gain over 10 years and still leave a $1 million financial legacy for distribution to heirs.

Death Benefits, MEC Limits, Term Insurance, & Reduced Paid-Up (RPU)

As previously stated, death benefits are adversely affected by age more than high early cash value growth. We’ve illustrated how we can get very similar early cash value growth trajectories regardless of age by designing a 10/90 split ratio policy.

Why Such High Death Benefits?

A $14.25 million death benefit as shown in Scenario #1 may seem excessive to most of us. But it’s not unusual for high-net-worth individuals and couples whose wealth exceeds the federal estate tax exemption (2021: $11.7 million for individuals - $23.4 million for couples). Whole life insurance falls outside of the estate valuation meaning death benefits serve as a tax-exempt estate transfer for the wealthy.

For example, if an individual estate is valued at $12.7 million, then $1 million would be taxable under current exemptions. So, this individual could transfer $1 million to whole life insurance thereby removing it from the estate valuation and circumvent taxes on the $1 million. Tax-exempt death benefits, which include paid-in capital, are then distributed to heirs.

But for the rest of us in the 99%, and particularly those aged 60+, it’s an unrealistic amount. The reason death benefits are so high in Scenario 1 is because they’re tied to an IRS-defined 7-pay MEC (Modified Endowment Contract) test. So, the desired $1 million lump sum MEC limit in the first year forces a $14.25 million death benefit carry. Notice how the value decreases in scenarios 2 and 3 as we spread paid-in capital over longer duration with a lower annual pay-in, MEC limit, and death benefit as a result.

The 7-pay test refers to the first seven annual premium payments and cannot be changed once the insurance contract is in force. It can be restarted, but it essentially becomes a new contract, and the policyholder has to reabsorb high insurance expenses in the first few years resulting in a drag on cash value savings growth.

So, it’s important to find the most efficient funding model at the outset because we’re locked-in for the 7-year MEC test period once the policy is in force. If we set a MEC limit too high, then more of the paid-in capital has to go toward supporting the accompanying higher death benefit rather than cash value savings growth. Too low results in a lost opportunity cost if additional funds become available down the road. Like Goldilocks’ porridge, we want a MEC limit that is just right.

Boosting Death Benefits with Term Insurance

If you’re researching cash value life insurance you’ve no doubt seen critical content that whole life is too expensive, so buy term insurance. What these critics aren’t aware of is that an optimized cash value policy requires a considerable amount of term insurance to be purchased within the whole life policy. It’s a blend of guaranteed whole life and term insurance or a blended life insurance policy.

You can buy term insurance within a whole life policy but can’t buy permanent whole life insurance within a term policy.

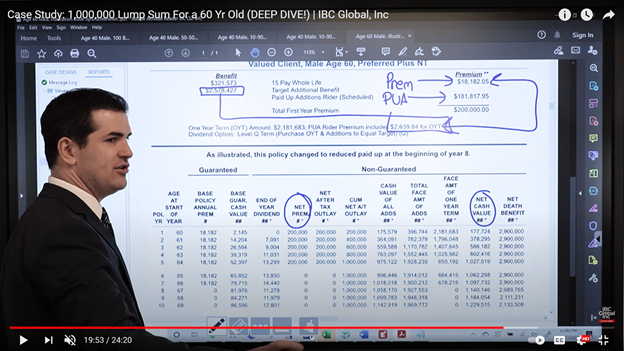

Let’s have a look at Scenario 3 to illustrate how this works.

The 7-pay MEC test tells us that we need a $2.9 million death benefit to support an annual pay-in of $200k. But that death benefit value doesn’t need to be carried for life, just for the 7-year MEC testing period. So, unless the policyholder wants that level of guaranteed death benefit coverage (which is costly for those in their sixties), we can boost death benefits temporarily with a renewable one-year term insurance rider (OYT) at lower cost.

The illustration below gives us a visual of how it works. At the top left, we see that the guaranteed death benefit for this whole life insurance policy is $321,573. We then exercise a temporary renewable term insurance rider of $2,578,427 at a cost of $2,640 to get us to a $2.9 million death benefit. So, nearly 90% of death benefit coverage in this example is through term insurance, not guaranteed whole life as many mistakenly believe.

After the 7-pay test period, we simply let the one-year term insurance rider lapse. Alternatively, the policyholder can choose to continue with term insurance, but it will create a drag on cash value savings growth. And if we want to stop premium payments as well, we can exercise a Reduced Paid-Up option which we cover next.

Reduced Paid-Up Insurance (RPU)

RPUs are a must-have for wealth transfers due to the short-term funding timeline. Otherwise, we’d be stuck paying insurance premiums-for-life as many whole life insurance critics insist is true. An RPU allows us to stop premium payments thereby locking in a fully funded guaranteed death benefit at any time after the 7-pay MEC test period.

Whole Life Insurance Death Benefit Highlights (000)

Funding Model

Year LS 3-Pay 5-Pay Age

1 $14,250 $4,750 $2,900 60

8 – RPU $1,624 $2,071 $2,090 67

12 $1,695 $2,161 $2,181 71

20 $1,879 $2,397 $2,418 80

If we look at the 8th year, we see some large swings in death benefits after the RPU is put into effect. When an RPU is exercised, the insurance company calculates the guaranteed death benefit based on actuarial factors and cash value savings. Remember that 90% (10/90 split) of the $1 million paid-in capital is included in the death benefit calculation. It’s the policyholder’s money after all unless it’s assigned as collateral.

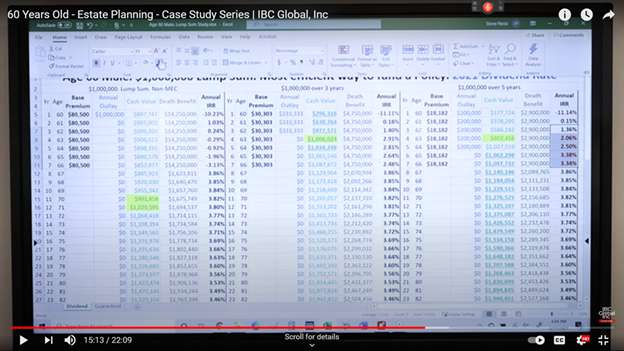

Dividend Rates do not Equal Financial Returns

There is a considerable amount of confusion around the dividend rates and financial returns of whole life insurance. We have content on this exact issue elsewhere. It’s not unusual for potential policyholders to think that an announced dividend rate of 6% is equal to the financial return on invested capital.

For example, it may be assumed that $1 million in lump-sum funding earning a 6% annual dividend rate results in a first-year financial return of $60,000. It doesn’t work like that. Although cash value life insurance earns a comparatively high financial return in its asset class, it’s not the 5% or 6% that many think.

The announced dividend rate is a gross rate meaning that administrative costs, mortality charges, and cost of insurance have not yet been deducted. The ballpark net rate or internal rate of return (IRR) is generally around 1-2% lower than the announced rate.

There are several ways to calculate financial returns. The IRR shown in the example below signifies the annual rate of return. A look at year 10 reveals an IRR of 3.84% for that year. One problem of using IRR as a measuring stick is that it’s a complicated calculation involving the time value of money. Secondly, it’s a short-term financial ratio whereas cash value life insurance is a long-term asset. We can liken it to qualified retirement plans where we’re urged to look at long-term results rather than annual returns.

For many, using the more easily calculated return on investment (ROI), average rate of return (ARR), or return on equity (ROE) is a more relevant ratio for a long-term asset. It calculates the profit or gain on invested capital over time. This is not to be confused with the annual average return on investment or equity as we illustrate below.

Return on Paid-In Equity (000)

Scenario 1 – Lump Sum

Avg.

Year Age Paid-In CV Gain ROE Annual

Equity (Loss) % ROE

8 67 1,000 886 (114) -0.01% -1.5%

12 71 1,000 1,130 130 13% 1.1%

21 80 1,000 1,422 422 42.4% 1.9%

Scenario 2 – 3-Pay

Year Age Paid-In CV Gain ROE Avg.

Equity (Loss) % ROE

8 67 1,000 1,130 130 13% 1.8%

12 71 1,000 1,313 313 31.3% 2.5%

21 80 1,000 1,814 814 81.4% 3.2%

Scenario 3 – 5-Pay

Year Age Paid-In CV Gain ROE Avg.

Equity (Loss) % ROI

8 67 1,000 1,140 140 14% 1.7%

12 71 1,000 1,325 325 32.5% 2.6%

21 80 1,000 1,831 831 83.1% 3.2%

So, the most efficient funding model design for this 60-year-old real estate investor to transfer $1 million into whole life insurance is the 5-pay in Scenario 3. An average annual 3.2% financial return on paid-in equity over 20 years is comparably high for its asset class in our current low-interest economy.

The Wrap – Whole Life Insurance for 60- to 69-Year-Olds

So, as you can see, there is still a very attractive cash value incentive to consider for someone in their 60s who might think they’re too old to take advantage of the benefits of whole life insurance. We can design a policy for older individuals that maximizes early cash value growth and still provides death benefits albeit at a reduced amount.

A cash value life insurance policy isn’t going make those in their sixties rich, but it serves well as a wealth preservation and financial legacy tool. We are not financial planners or investment advisors so we can’t speak to the best place to preserve wealth during uncertain economic times. But we do know with relative certainty that whole life insurance is one of those places. How? Because banks use cash value life insurance as a tier-1 asset holding to meet their core capital regulatory requirements.

A tier-1 asset has two primary elements – safety and liquidity – both of which are achieved through whole life insurance. From a safety perspective, stress tests of the insurance industry deem it to be well-capitalized and was even found to have a stabilizing effect on the financial industry during the financial crisis in 2008/09. From a liquidity perspective, cash value savings can be converted into tax-exempt cash within just a few days through cost basis withdrawals or policy loans.

According to the FDIC, more than 3,700 banks held roughly $190 billion in bank owned life insurance in the third quarter of 2019. This appears to contradict critics that consider whole life insurance to be a bad financial strategy.

We also have whole life insurance solutions for not-so-healthy individuals in their sixties who are looking for financial legacy, wealth preservation, and cash value private banking solutions. For example, rather than taking out life insurance, paying high premiums due to health, and listing grandchildren as beneficiaries, you can fund and own policies on them and transfer ownership at a predetermined milestone like turning 18- or 21-years-old or upon your death.

Lastly, we can’t stress enough the importance of policy design in generating the highest early cash value returns possible. We saw above how seemingly insignificant design variations can impact cash value performance. There’s also flexibility of design that allows for additional insurance coverage for long-term care and accelerated death benefits for chronic and terminal illness situations.

We train insurance agents throughout the country on how to use these whole life insurance policy design techniques for maximum cash value growth.

If you’d like more information on how to use a whole life insurance policy to maximize your tax-free cash position, you can view instructional videos on the IBC Global YouTube channel. You can also contact us for a free, no-obligation consultation from one of our Innovative Life Insurance Specialists

.png)