How to Finance Real Estate With Whole Life Insurance

How to Finance Real Estate with Cash Value Life Insurance

When most people hear about whole life insurance, they tend to think of it as just a policy for individuals. Banks and other corporations use whole cash value life insurance as tax-exempt funding mechanisms for deferred compensation and employee benefits programs.

Real estate investors are another group that can use cash value life insurance as tax-exempt financing mechanisms for property purchases. Interest rates on policy loans are typically lower than, or at least competitive with, bank loan rates. Further, tax-exempt cash value earnings growth within the policy continues unabated helping to offset loan interest expense often resulting in lower overall financing costs.

We’re going to touch on a popular concept which involves using a dividend paying whole life insurance policy, a high cash value life insurance policy, to finance real estate investments. Many real estate investors have adopted cash value insurance not only to finance investment opportunities, but to park money where they typically obtain higher yields than competing low-risk financial products.

Cash Value Life Insurance Primer

While guaranteed death benefits are an important component of whole life insurance, it’s the cash value feature that is of most interest to real estate investors. Advantages to real estate investors are fivefold:

- They traditionally provide higher returns than savings accounts and Treasury Bills. Guaranteed interest returns of 4% and discretionary annual dividends ranging from 0-6%.

- These returns are tax-exempt as long as the policy remains in compliance.

- Easy-access tax-exempt policy loans provide the liquidity real estate investors need.

- Cash value earnings continue to grow as if the policy loan was never taken.

- Cash value funds are protected from creditors.

The best way to explain this is through examples.

Example 1

A real estate investor has built up $500k in cash value equity within a whole life insurance policy. Those funds have a 4% interest guarantee plus discretionary annual dividends (2020 saw 5-6% dividend returns).

The investor has their eye on a $350k property but must move quickly. They contact their insurance agent to initiate a cash value policy loan. There’s no approval process or credit check because the insurance company is using the policy’s death benefits as collateral. So, loan proceeds are typically received within a short time.

Since it’s a policy loan, the insurance company is going to charge interest, let’s say 5%. At this point, you may be wondering why you are paying interest on your own money. It is because the insurance company is issuing a loan and using the cash value policy as collateral similar to other collateralized financing.

So, what’s the benefit, you may ask? Interest is being charged whether the loan is from a bank or the insurance policy. On the surface, it looks like a $350k policy loan from $500k of cash value equity would result in a remaining cash value of $150k. And that subsequent cash value earnings would be based on this lower amount. However, it doesn’t work that way.

Your cash value remains at $500k even after the $350k loan because the funds are a collateralized loan, not a withdrawal of funds. What does this mean? You will continue to receive cash value earnings on the entire 500k. So, you’re paying interest on $350k but receiving cash value earnings on $500k. To illustrate, 5% interest on the $350k loan is offset by the 5% earnings on $500k cash value equity. Of course, these interest rates are just examples to show that borrowing costs are offset by cash value returns.

It’s similar to real estate investments. If you own a $1 million commercial property and use it as collateral for a $500k loan, you still realize returns on the $1 million property value, but pay interest on the 500k loan.

How Does Loan Collateralization Work?

Example 2

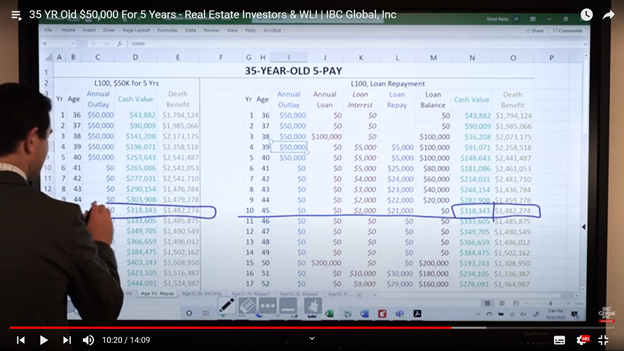

It’s best to illustrate how this policy loan process works. Below is a screenshot from another real estate video. We have a 35-year-old protagonist who wants to pay $50k annually into a whole life insurance policy for five years and take out policy loans for real estate investment. Notice the $50k Annual Outlay column and Cash Value and Death Benefit columns to the right in both the no-loan and loan example.

The investor takes out a $100,000 policy loan in the third year as seen in the right-hand example. So, what happens? Let’s compare the data for year 3:

| Year 3 | No-loan Example | Loan Example | Difference |

| Death Benefit | $2,173,175 | $2,073,175 | $100,000 |

| Cash Value | $141,208 | $36,208 | $105,000 |

Notice that the Death Benefit on the loan example is reduced by the $100,000 loan amount. This illustrates collateralization of the loan. The insurance company puts a claim on $100k of death benefits as surety for the loan. If the loan remains unpaid upon the death of the policyholder, the amount is deducted from beneficiary proceeds.

Also notice that the Cash Value is reduced by $105k which represents the loan amount plus $5,000 in first year interest.

Now, as the loan is repaid, you’ll notice that the Cash Value and Death Benefit increase. If you track down those columns to year 10 when the loan has been completely repaid, you’ll notice that the Cash Value and Death Benefit amounts are equal in both scenarios. Everything is fully restored once the loan is repaid. Cash value earnings continued to accumulate as if the loan was never taken.

Paying the Loan and Interest

A major benefit of cash value policy loans is that there is no repayment schedule. It can be repaid quickly, slowly, or not at all meaning it can remain outstanding and deducted from beneficiary proceeds upon death.

Paying interest on the loan is advised. Compound interest accumulates and increases your loan balance if it’s not paid. Your policy can be put at risk if the loan balance grows to exceed cash value equity. It’s important to avoid this situation.

We suggest consulting with a qualified tax advisor to find out if interest expense on the policy loan is deductible for tax purposes. Tax legislation is outside our scope of expertise, but we can suggest speaking to a tax expert to understand the tax implications of using cash value life insurance to finance your real estate investments.

Policy Design is Critical for Cash Value Optimization

Maximum cash value whole life insurance policies are flexible tax-free savings vehicles. Cash value funds can be used in emergency situations, real estate investment financing, and act as an annuity during your retirement years. In fact, there are no limitations as to how policyholders use loan proceeds.

Not all whole life insurance policies are created equal. For real estate investors, policy design should focus on accelerated cash value growth. Some policy designs take 7-14 years to reach cash value breakeven whereas we can typically achieve breakeven in 3-5 years. It all comes down to policy design.

There are many advantages to using cash value life insurance as a funding tool for real estate investments. It’s important to compare the yields, liquidity, tax-exempt status, and creditor protection of whole life insurance to other financial instruments and real estate financing sources.

If you’d like more information on how to use a whole life insurance policy for real estate investments, we have several real estate investor instructional videos and case studies on the IBC Global YouTube channel. You can also contact us for a free, no-obligation consultation from one of our Innovative Life Insurance Specialists.

.png)