Case Study: 50 YR Old Male - $10,000 Per Year For 10 Years

Are People Aged 50-59 Too Old for Whole Life Insurance?

It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for. — Robert Kiyosaki Rich Dad Poor Dad

Those 50- to 59-years-of-age are not too old to benefit from cash value life insurance. Of course, qualifying at a reasonable premium is conditional on an individual’s health and mortality risk. And although average life expectancy has stagnated somewhat, those who are healthy in their 50s may live another 40 years if they keep to a healthy lifestyle. This leaves time to take advantage of the compound cash value savings growth of whole life insurance.

But financial growth aside, there are additional advantages to permanent cash value life insurance for those over 50 years of age like :

- wealth preservation - leverage savings in a secure environment,

- establishing a personal, business, or family bank,

- creating an additional retirement income stream,

- establishing, protecting, or fortifying a tax-exempt estate transfer to heirs.

Those in their 50s are typically in their peak earning years and have more disposable income to leverage a cash value whole life insurance policy. Principle residence mortgage payments have typically reached or are near an end, children’s tuition has been taken care of, and market and qualified retirement assets have been accumulating for 20-30 years. Thoughts then start to turn toward having sufficient cashflow to retire comfortably, wealth preservation, and leaving a financial legacy to heirs.

Shelly Gigante, personal finance writer for MassMutual, describes this stage as entering the “wealth transfer zone.” Although the wealth accumulation phase hasn’t ended, locking in prior long-term gains begins to take shape. As you’ll see below, individuals 50- and 55-years-old have transferred or are in the process of transferring a sizable portion of their wealth to cash value life insurance to preserve its value and establish or increase their financial legacy.

Do I Need a Lot of Money to Benefit from Whole Life Insurance?

This is the second most asked question for people in their fifties, “don’t I need a lot of cash to get started with cash value life insurance?” If cash value performance is the priority, then it helps to meet at least one of two financial scenarios: high liquid or near-liquid assets and/or high income.

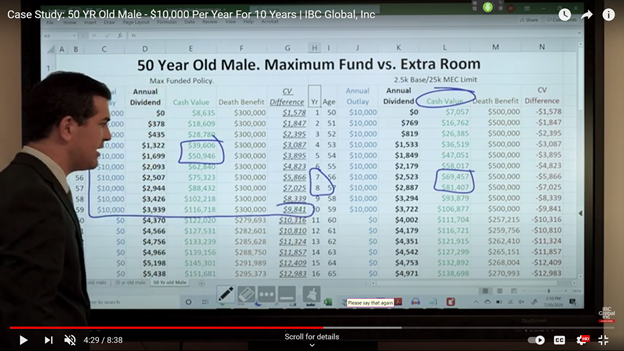

The illustration below documents how a working 50-year-old with an extra $10,000 in annual disposable income can create a six-figure cash value account and with more than $200,000 in death benefits in just 10 years.

Policy Design #1 – Maximum Funding – The policyholder wants to contribute $10,000 per year for 10 years and then stop premium payments. He doesn’t have the disposable income to contribute more than $10,000 per year and therefore doesn’t have a need for additional MEC space. So, we establish a $10,000 MEC limit. A Max Funded policy means that contributions equal 100% of the MEC limit.

Policy Design #2 – Allow for Increased Contributions – This policy design has the same funding model, but the client wants the ability to contribute an additional $15,000 annually. So, we establish a $25,000 MEC limit by boosting death benefits to the appropriate amount through a low-cost renewable term insurance rider. Unused MEC space is cumulative rolling forward year-after-year.

So, both policies have the same design except for MEC limits. This example compares the cash value growth of a max-funded MEC-limit to an under-funded policy with unused MEC space to illustrate how slight differences in policy design can have a big impact on cash value savings growth.

The illustration below confirms that unused MEC space can cause a drag on cash value growth compared to maximum MEC limit funding. Policy Design #1 reaches cash value breakeven just after the 4th year. There’s $40,000 paid-in capital vs $39,606 cash value. The under-funded policy on the right doesn’t breakeven until the 7th year.

A fully funded policy design that maximizes MEC limit contributions produces $9,841 more in cash value over 10 years than an identical funding model but with a higher, yet unused, MEC limit. Why? The cost of the term life insurance required to increase death benefits to support the higher MEC limit is one reason. Secondly, the max funded policy has $1,578 more in cash value equity right out of the gate in the first year boosting early compound growth.

Does this mean you shouldn’t build additional MEC space into the policy design? No, but it should be a realistic number because the higher cost for term insurance coverage will slow cash value growth if left unused. But the whole picture changes if both parties, for example, receive an $80,000 inheritance in the 8th year.

Policy Design #2 can lump sum it into the policy to juice cash value growth because they have cumulative MEC space available.

Policy Design #1 will have to look for other solutions like taking out a 2nd cash value life insurance policy but will have to again absorb insurance expenses in the first two years. So, there are pros and cons to carrying a higher MEC limit that need to be considered in the policy design stage.

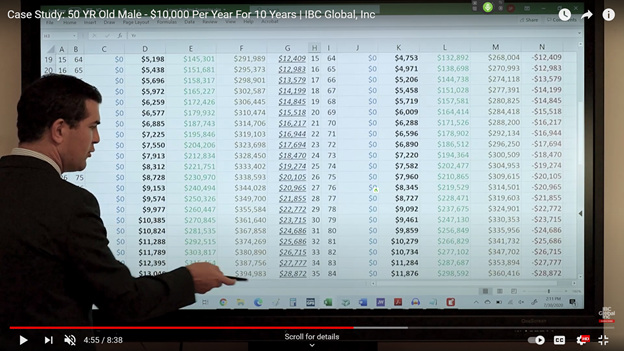

Now if we look below at cash value in the 16th year at age 65, we see the max funded policy has $151,681. So, from 50-years-old to age 65, $100,000 in paid-in capital has generated a $50,000 increase in cash value equity for an average return on paid-in capital of 5% and a death benefit of nearly $300,000. Policy Design #2 increased cash value by $38,698 for a 3.7% return on paid-in cash savings and a $270,000 death benefit.

The example above illustrates how seemingly minor policy design differences like MEC limits can impact cash value growth. It’s the whole life insurance version of the butterfly or ripple effect. A standard reply to insurance agents when given whole life policy design options like carrying a higher MEC limit just in case should be “run both scenarios through the illustration software” and then determine a realistic limit.

So, there is an opportunity for a healthy individual in their 50s to take advantage of cash value life insurance. Intelligent policy design, however, is critical to cash value optimization.

The next example illustrates how a successful 55-year-old put us to work by requesting illustrations for multiple scenarios to get an idea on how the numbers may play out before deciding.

Can a 55-Year-Old Use Whole Life Insurance as a LIRP?

We often hear from high-income, high-net-worth individuals interested in using a whole life cash value savings account to preserve wealth and possibly act as an additional retirement income stream. The unique combination of features available in a permanent whole life insurance policy, unmatched in any single financial instrument, positions it as a potentially valuable wealth preservation, retirement, and estate planning tool.

The individual in our next illustration had done significant due diligence on cash value life insurance. It was obvious because he had clearly studied the features and knew exactly how to use it to his advantage. His prioritized objectives were typical of moderate- to high-net-worth individuals:

- Asset preservation – We’re living in a time of economic uncertainty. We’re seeing more moderate- to high-net-worth individuals looking to lock in prior market gains by sheltering a portion of their wealth due to this uncertainty.

- Retirement income – He wants to use cash value life insurance to supplement retirement income. Specifically, he wants to see an illustration on the funding models needed to draw an annual retirement income from age 65 to 95-years-old and another beginning at 70-years-old until 95-years-old.

- Real estate investment tool – The client speculates in real estate and wants to use cash value policy loans as a real estate investment fund. Although liquid assets are protected within a whole life insurance policy, investment opportunities can still be acted on through insurance loans at comparably low interest rates and without impacting cash value growth.

- Financial legacy planning – The client has a high net worth and may exceed the estate tax exemption. So, death benefits serve as a tax-free wealth transfer to heirs outside of the deceased’s estate.

Whole Life Asset Protection for People in Their 50s

Using cash value as a wealth preservation tool is the easy part. Participating whole life insurance is guaranteed to grow and, at least in recent years, has covered the inflation rate. So, the spending power or value of cash assets doesn’t decline if the financial return covers the inflation rate. There have been few low-risk financial instruments that have covered the inflation spread over the past few years. Cash value whole life insurance is one of the few.

This individual has a high net worth with no funding limitations. He gave us a destination of where he wants to be in 10 years and asked us to reverse engineer the policy design to meet that goal.

So, these are the specs he laid out for us:

- How much annual funding is needed to draw a $125,000 annual income stream from age 65 to 95 years of age?

- What do the numbers look like if I let cash value grow until I’m 70-years-old before drawing an annual retirement income stream until age 95?

- Use a conservative credible approach. He had fully researched cash value life insurance so no agent in the country could put one over on him using inflated numbers.

We agree with taking a conservative approach in our illustration proposal to prospective policyholders because we want to temper expectations. Proposing conservative numbers create a realistic expectation.

For example, current whole life insurance policyholders were guaranteed a fixed 4% return which refers to the worst-case scenario or lowest possible return. Now if the actual return comes in at 5%, then there’s no problem. The client is happy. But if we illustrate the guaranteed value plus a high surplus dividend rate and project an unrealistic 8% return and the actual is 5%, then we’ve created an unrealistic expectation and the result is an unhappy client.

Moreover, the conservative approach requested indicates that financial returns weren’t the deciding factor. He knew that he could getter higher returns elsewhere, so it was likely the combination of features that he found attractive: security, spending power maintenance, creditor protection, tax-exempt growth, tax-exempt estate transfer, and liquidity options. Even billionaires take advantage of this combination of features and benefits of whole life insurance.

How to Create a LIRP with Whole Life Insurance

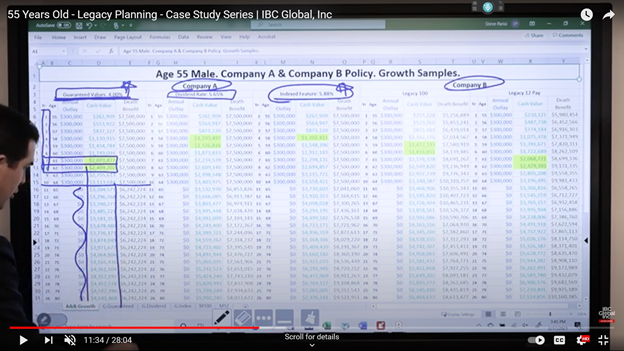

We ran the numbers through our illustration software as requested. The result was ballpark funding of $3 million spread over 10 years. We were able to obtain a 9/91% premium split ratio and used the 2021 dividend rate of 5.65% from the company’s press release. We used a 3% inflation rate to factor in the time value of money.

The initial plan is to stop premium payments by exercising a reduced paid-up (RPU) option after the 10-year funding period. But the client wants to keep the funding door open in the event he has to shift his financial strategy and protect additional capital in the future.

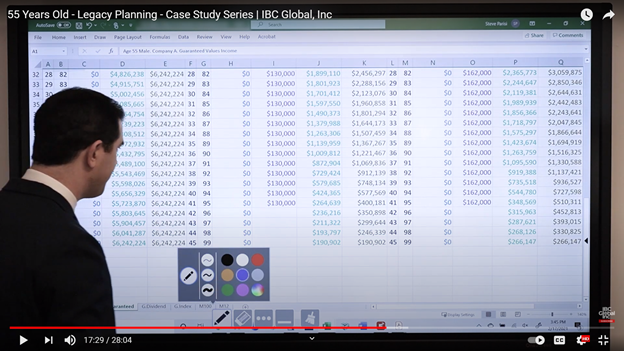

The illustration below shows how the numbers may play out for different whole life insurance product types and companies.

Company A illustrates cash value performance based on the guaranteed rate of 4% using an open or flexible policy design. Guaranteed value illustrations are often referred to as a worst-case scenario because the insurance company is mandated by current legislation to return a minimum of 4%. (Changes are in the works).

In the center, we illustrate a whole life insurance policy with an index feature meaning financial returns are tied to an investment index like the S&P 500.

Company B illustrates two whole life insurance packages for comparison purposes. The Legacy 100 signifies premium payments for life capped at 100 years old. As you can see, we halted premium payments after 10 years using the reduced paid-up option and established a reduced, but fully funded death benefit. Legacy 12-Pay illustrates a limited-pay option meaning premium payments automatically stop after the 12-year funding period.

The myth that whole life cash value life insurance policyholders have to pay premiums for life is simply not true if the policy is designed correctly. Because of the long-term nature of a cash value insurance policy, it’s important to build flexibility into the design without impacting cash value savings growth. We refer to it as creating the most efficient policy design possible based on the client’s priorities.

Whole Life Insurance Growth Illustrations for 50-59-year-olds

Thousands (000)

| Product | B/E Year | Paid-in Capital | Cash Value |

| Guaranteed Values 4% | 8 | $2,400 | $2,409 |

| 2021 Dividend Rate 5.65% | 5 | $1,500 | $1,526 |

| Indexed 5.88% | 4 | $1,200 | $1,212 |

| Legacy 100 | 6 | $1,800 | $1,816 |

| Legacy 12-Pay | 8 | $2,400 | $2,429 |

| Product | Year | Paid-In Capital | Cash Value | Year | Cash Value |

| Guaranteed Values 4% | 10 | $3,000 | $3,114 | 25 | $4,547 |

| 2021 Divident Rate 5.65% | 10 | $3,000 | $3,404 | 25 | $5,779 |

| Indexed 5.88% | 10 | $3,000 | $3,558 | 25 | $7,065 |

| Legacy 100 | 10 | $3,000 | $3196 | 25 | $6,145 |

| Legacy 12-Pay | 10 | $3,000 | $3,196 | 25 | $7,230 |

Beware of Illustrations Using Non-Guaranteed Values

Legacy 12-Pay has slower cash value growth out of the gate and takes longer to reach breakeven compared to the Guaranteed Value or worst-case illustration. But cash value growth picks up resulting in the highest cash value by year 25. However, we need to qualify that the Legacy 12-Pay is based, in part, on non-guaranteed values.

So, whether these numbers are achievable in an uncertain economy remains to be seen. So be careful making a decision based on nonguaranteed financial returns. Long-term results may not come to fruition. 12-Pay also pays higher commissions to insurance agents so be aware if you experience a hard sell on packaged insurance products.

For us at IBC Global, we do not promote life insurance products based on compensation. We believe that a sustainable insurance business is based on doing the right thing, treating others how you want to be treated, and offering transparency. So, we illustrate:

- several policy design options based on the client’s stated goals

- different insurance company offers best suited to the client’s needs

- cash value design optimization for accelerated growth

We typically suggest an open policy design that gives us the flexibility to optimize a whole life policy based on the policyholder’s priorities. A closed off-the-shelf whole life insurance policy doesn’t offer that degree of flexibility.

We provide several policy design illustrations from different mutual companies so the individual can select the option that they are most comfortable with. We don’t try to sell them or push them in a particular direction although we typically recommend mutual insurance companies that are owned by policyholders.

We want the policyholder to be happy with their choice, not experience buyer’s remorse, and to recommend us to family, friends, and colleagues. Referral business is a much better way of acquiring clients than cold calling.

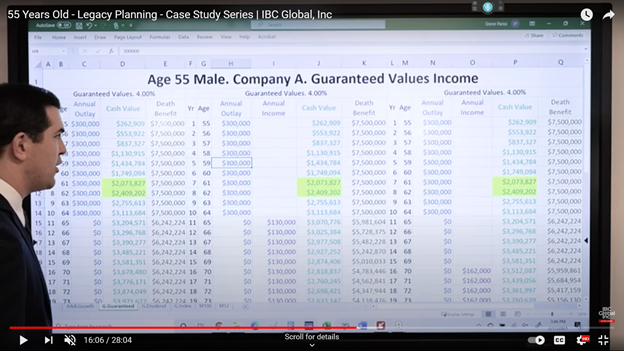

Guaranteed Values LIRP Illustrations for a 55-Year-Old

Whole life insurance income illustrations show both cash value growth and how the withdrawal of an annual retirement income by the policyholder affects policy values. The first scenario shows us how the policy would perform at guaranteed values (worst case) if allowed to grow without withdrawals. The middles scenario illustrates an annual withdrawal of $130,000 starting at age 65 and the righthand scenario starting at 70-years-old.

The policyowner is drawing $130,000 or $162,000 from cost basis meaning after-tax paid-in and PUA contributions. Because paid-in capital has already been taxed it is exempt from double taxation. So, at year 10 we have contributed a basis of $3 million and have a cash value of $3.1 million. Money is withdrawn on a FIFO basis up to the $3 million of paid-in capital. Taxes are only applicable to the $100,000 in cash value growth to-date after the $3 million basis is withdrawn.

Policy values are identical at year 10 when we stop paying premiums. Let’s look at how policy values play out based on just guaranteed values at different ages.

Note: these numbers are identical in the 2 tables. Wasn’t sure of the best way to present it.

Table 1

| Scenario | Year | Cash Value | Total With. | DB |

| Age 64 | ||||

| 1/No withdrawls | 10 | $3,114 | $0 | $7,500 |

| 2/Withdrawls at 65 | 10 | $3,114 | $0 | $7,500 |

| 3/Withdrawls at 70 | 10 | $3,114 | $0 | $7,500 |

| Age 70 | ||||

| 1/No Withdrawls | 16 | $3,678 | $0 | $6,242 |

| 2/Withdrawls at 65 | 16 | $2,819 | $780 | $4,783 |

| 3/Withdrawls at 70 | 16 | $3,512 | $162 | $5,960 |

| Age 80 | ||||

| No Withdrawls | 26 | $4,641 | $0 | $6,242 |

| Withdrawls at 65 | 26 | $2,084 | $2,080 | $2,803 |

| Withdrawls at 70 | 26 | $2,596 | $1,782 | $3,491 |

| Age 95 | ||||

| No Withdrawls | 26 | $5,724 | $0 | $6,242 |

| Withdrawls at 65 | 26 | $265 | $4,030 | $500 |

| Withdrawls at 70 | 26 | $349 | $4,212 | $510 |

Table 2

| Growth (1) | Age 65 (2) | Age 70 (3) | |

| Age 64 | |||

| Cash Value | $3,114 | $3,114 | $3,114 |

| Total Withdrawls | $0 | $0 | $0 |

| Death Benefit | $7,500 | $7,500 | $7,500 |

| Exercise Reduced Paid-Up Option | |||

| Age 70 | |||

| Cash Value | $3,678 | $2,819 | 3,5120 |

| Total Withdrawls | ($0) | ($2,080) | ($1,782) |

| Death Benefit | $6,242 | $34,783 | $5,960 |

| Age 80 | |||

| Cash Value | $4,641 | $2,084 | $3,512 |

| Total Withdrawls | ($0) | ($2,080) | ($1,782) |

| Death Benefit | $6,242 | $2,803 | $3,491 |

| Age 95 | |||

| Cash Value | $5,724 | $265 | $349 |

| Total Withdrawls | {$0) | ($4,030) | ($4,212) |

| Death Benefit | $6,242 | $500 | $510 |

The Wrap – Whole Life Insurance for 50- to 59-Year-Olds

Financial planners typically recommend that as we move closer to retirement age, we should reduce financial risk to lock-in and preserve prior investment gains. Shelly Gigante describes this period as the wealth transfer zone which typically begins in our fifties. And with dim economic prognoses in the near- to mid-term, it may be more important than ever to start transferring some wealth to safer ground.

We are not financial planners or investment advisors so we can’t speak to the best place to preserve wealth during uncertain economic times. But we do know with relative certainty that whole life insurance is one of those places. How? Because banks use cash value life insurance as a Tier-1 asset holding to meet their core capital regulatory requirements.

A Tier-1 asset has two primary elements - safety and liquidity - both of which are achieved through whole life insurance. From a safety perspective, stress tests of the insurance industry deem it to be well capitalized and was even found to have a stabilizing effect on the financial industry during the financial crisis. From a liquidity perspective, cash value savings can be converted to tax-exempt cash in just a few days through cost basis withdrawals or policy loans.

Furthermore, although cash value life insurance has a savings component that earns tax-exempt financial returns, it is considered by law to be primarily life insurance. And life insurance typically offers additional protection from creditors and tax authorities although it varies by state from partial to full protection. This protection ceases in the case of fraud, for example, shoveling money into a whole life policy to shelter it from bankruptcy proceedings. But otherwise, it’s an advantage to look into.

While a wealth transfer to safer ground is an option for some, moderate- to high-income 50- to 59-year-olds can still generate sizeable cash value savings by funding a policy with discretionary income. Whether it’s to grow a financial legacy, create a life insurance retirement plan (LIRP), implement a banking strategy, or all of the above, cash value life insurance enjoys more protection than most other financial alternatives.

Lastly, we can’t stress enough the importance of policy design in generating the highest cash value returns possible. We saw above how seemingly insignificant design variations can impact cash value performance. We not only design high-performance cash value life insurance for clients, but also teach it to agents throughout the country.

If you’d like more information on how to use a whole life insurance policy to maximize your tax-free cash position, you can view instructional videos on the IBC Global YouTube channel. You can also contact us for a free, no-obligation consultation from one of our Innovative Life Insurance Specialists.

.png)