How the 1% Uses Whole Life Insurance

Mimicking the Wealthy When Designing Whole Life Insurance Policies

Whole Life Insurance Policy Design: Mimicking the Wealthy

Follow the Smart Money for Whole Life Policy Design

Most major banks and many other Fortune 500 companies hold billions of dollars of whole life insurance as balance sheet assets year-after-year. They use them for several reasons but primarily as safe long-term funding mechanisms for employee benefit, pension, and deferred compensation programs.

They design cash value life insurance policies in a similar manner to IBC Global policy design recommendations. More accurately, we have studied historical corporate whole life insurance performance and mimicked their policy designs for the consumer marketplace. Who better to follow financial strategies from than individuals and corporations that have multi-disciplinary teams of legal and financial experts to design whole life insurance policies for maximum financial benefit?

Imitating the Rich is an Age-Old Financial Strategy

Imitating the financial strategies of the rich most likely arose when the first wealthy person appeared in history. It’s known by several names most commonly “copycat investing,” coattail investing,” and “following the smart money.”

Is it always a successful strategy? No, there’s too much volatility in the investment ecosystem. When it comes to secure, low-volatile, low-risk financial products like cash value life insurance, succeeding by imitating the wealthy is a lot more probable. They know about tax-exempt death benefits and cash value growth, how to accelerate that growth, how to benefit from cash value equity, and generally how to maximize the internal rate of return (IRR) throughout the life of the policy.

According to the FDIC, more than 3,700 banks held roughly $190 billion in Bank-Owned Life Insurance (BOLI) in the 3rd quarter of 2019. And that’s just banks, not other Fortune 500 corporations that place hundreds of billions more into cash value policies that function as efficient long-term funding mechanisms.

Many Not Aware of Optimal Policy Design Strategy

We often see online critics downgrading the many financial benefits of whole life insurance. My question is, “Why do banks move hundreds of billions into cash value life insurance if it doesn’t provide financial benefits?” “What do these critics deem to know that the most prolific investors in the history of humankind don’t know?”

As previously mentioned, following the smart money is not always a successful investment strategy. But if I do decide to mimic a financial strategy, I’m going to follow what other corporations and wealthy individuals with a long string of proven financial results rather than the opinions of internet critics.

We do recommend that people review cash value life insurance critics because they make some valid points that are of importance to be aware in making an informed financial decision. But if I’m designing a policy for maximum cash value growth potential, I’m going to imitate those that can show me decades of financial proof rather than the conjecture of detractors.

Many whole life insurance opponents don’t fully understand the critical importance of policy design in generating a maximum rate of return. We know this because they present policy illustrations that don’t reach cash value breakeven for 10 to 15 years. If it takes more than five years to reach a cash value equity position, then the problem isn’t cash value life insurance. The problem is that the design of the policy, is not the most efficient.

Those who illustrate these inefficient designs to potential policyholders often turning them off whole life insurance permanently. When prospects perform online due diligence, they quickly come across detractors that “confirm” cash value insurance is a bad financial product when, in fact, both parties lack knowledge in designing policies for maximum return.

Get a Second Opinion on Cash Value Policy Design

In both health and financial decisions, it can be prudent to get a second opinion. Do the numbers look bad because it’s a poor financial product? Or do the numbers look bad because it’s a poor policy design that isn’t presenting or doesn’t show the most optimal strategy for efficient cash value life insurance?

There are many who are unaware of the best practices for effective whole life insurance policy design. Since we train insurance agents throughout the country on how to use these exact same design strategies for maximum cash value growth, we’ve observed firsthand that many have never been properly educated in the technical aspects of optimal policy design.

When performing online due diligence on financial products it’s important to go beyond confirmation of our current understanding by searching for contrary positions from those who are producing different results. Only by understanding all sides of an issue can we weigh the pros and cons to make the most informed financial decision possible.

Why Imitate the Wealthy?

It’s important to understand the motivation for wealthy people to include cash value life insurance in their financial portfolios when they could potentially get higher yields elsewhere. What attracts them to whole life insurance?

The short answer to that question is that it’s not just one benefit that attracts them, but the unique combination of benefits they acquire through cash value life insurance. When looking at individual benefits, there are better, or at least equal, options to choose from. But viewed collectively, it’s a difficult combination to beat.

- Guaranteed Death Benefit

The wealthy use whole life insurance as an estate-planning tool. The guarantee offers peace of mind that no matter what happens in life The death benefit payout escapes the grasp of tax authorities providing beneficiaries with a tax-free inheritance.

Flexible Policy Rider Options

Policy riders enable individuals to customize insurance coverage to suit their life, financial and estate planning goals. Policy riders can provide for long-term and chronic care coverage should illness or injury occur. Chronic and terminal illness can be covered through an accelerated death benefit rider that provides ‘living benefit’ access to your policy should long-term or terminal illness strike.

A Low-Risk Financial Diversity Option

Society has taught us long ago to spread our money around to spread financial risk. Even the wealthy seek secure low-risk financial havens to position a portion of their wealth. Those who have a higher income typically take a conservative approach. Many will put a significant portion of their wealth into safe, relatively liquid cash reserves to fall back on if financial catastrophe strikes.

- Creditor Protection

If financial catastrophe like insolvency or bankruptcy does strike, cash value life insurance is protected from creditors in most scenarios. Always get a qualified legal opinion on these matters due to the complex web of federal and state laws, but generally whole life insurance values are protected.

Tax-Exempt Cash Value Growth & Death Benefit

Many wealthy people appear to detest paying taxes more than others. That could be more perception than reality, but tax-exempt wealth accumulation and death benefit distribution are good strategies to copy.

- Real Estate & Business Investor Hub

Real estate investors, and increasingly business owners, use cash value life insurance as an investment hub for all the reasons stated above and below. They can freely move funds into and out of the policy as needs arise and yet cash value earnings continue to grow as if all that activity wasn’t happening.

- Liquidity

One never knows when they’ll need a large sum of money quickly and whole life insurance provides that option. The policy loan function acts as a financial buffer against life’s negative financial events. And simultaneously removes the statement “if I only had the money” from the policyholder’s lexicon when positive events arise such as when a prized vacation property comes on the market. Wealthy people most always have liquid assets in the mix that act as both a hedge and opportunity fund.

- Competitive Guaranteed Returns

Long-term returns on cash value life insurance are better than, or at least competitive with, most other safe low-risk financial products. In a low-interest economy where we need a magnifying glass to find interest income on our bank statements, it’s nice to know there’s another option earning a guaranteed 3-5% and similarly liquid. The wealthy choose the financial option that produces the highest return in its financial class all other things being equal.

- Share in Insurance Company Profit

Even those with loads of money can appreciate the joy of receiving a financial bonus. Dividends are a share of insurance company profit. They’re not guaranteed so they are, in essence, a bonus. The wealthy know that when faced with a decision between financial options with similar guarantees, choose the one that includes the potential of bonus income. It’s the proverbial cherry-on-top.

It’s difficult to argue against any one of the benefits of cash value life insurance described above let alone collectively. Wealthy people, banks, and corporations find financial value in whole life insurance or they wouldn’t be pumping in billions per year. They find financial value because they know how to strategically design a cash value policy that produces maximum return. So, how do they do it?

Corporate-Style Whole Life Insurance Policy Design

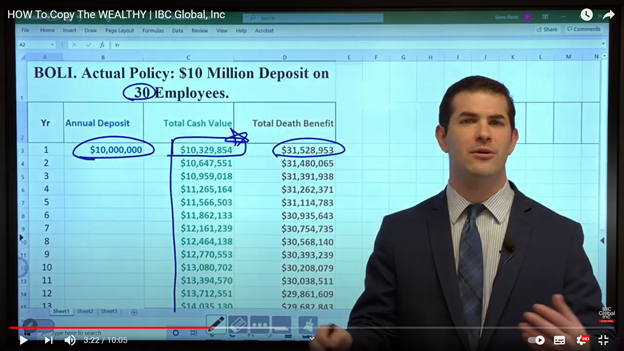

Let’s review a typical BOLI or Bank Owned (Cash Value) Life Insurance. This is for illustration purposes to demonstrate how a high-efficient policy is designed although you and I don’t actually get access to all the bells-and-whistles of a BOLI. But intelligently designing a personal high cash value life insurance policy uses the same principles.

One of the differences is that a BOLI can group employees into one policy as shown in the screenshot below. The bank is deposits $10 million into the bank-owned life insurance policy for 30 employees. Notice that the initial deposit results in $10,329,854 in year one cash value. It’s nearly $330,000 higher than the initial cash input. It also generates a first death benefit of more than $30 million or roughly $1 million per employee. The death benefit is typically paid, or partially paid, to the corporation and used to recover insurance program costs.

Now a BOLI is a little bit of a different animal as far as the MEC status, but the main point that everyone is interested in is that cash value and how to design a policy that has similar effect.

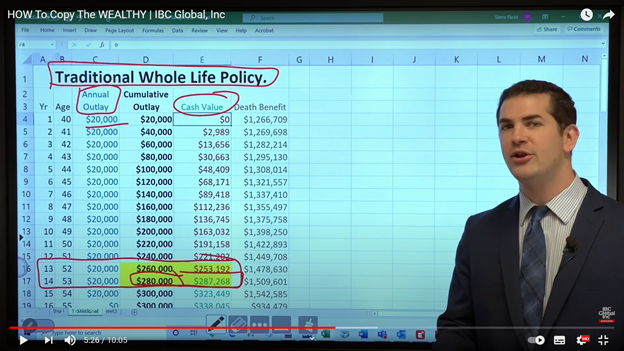

Why Banks Don’t Use Traditional Whole Life Insurance

A quick glance at the screenshot below shows graphically why banks and corporations avoid traditional whole life insurance when creating a policy for high cash value growth. If we look at first-year cash value, we see that our initial outlay of $20,000 resulted in a big goose egg. Absolutely zero cash value.

And it takes as long as 13-14 years until cash value breakeven is reached after plowing in close to $280,000. Banks, corporations, and the wealthy would never enter into such an agreement. And neither would we which is why we also copy what they don’t do when designing a high growth cash value life insurance policy.

The initial funds transferred into a traditional whole life insurance policy are going to insurance expense and death benefit overcharges. Cash value growth eventually takes hold but waiting 14 years isn’t something I’m prepared to do.

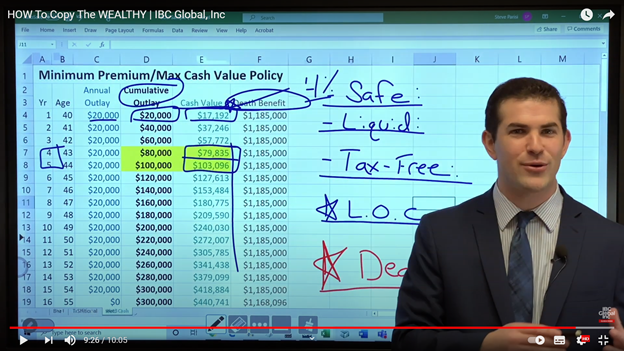

High Cash Value Growth Policy Design

To review for those that are accessing our whole life insurance content for the first time. We can allocate the money going into a high-growth policy to the premium and Paid-Up Additions (PUA). This funding split could be 50/50, 60/40, or any other ratio. We like to use a 10/90 split when designing a policy for accelerated cash value growth.

Let's review our previous example but using an elevated cash value growth approach. Same company, same outflow for the consumer, everything is identical. The difference is the design. A second difference of a BOLI or corporate-owned life insurance policy is that while they can reach cash value breakeven in the first year, it’s impossible for a consumer-owned whole life policy to perform the same.

But by implementing the same design principles, consumer-owned policies can reach breakeven in 4-5 years, roughly a decade sooner than the traditional whole life insurance example. First year cash value isn’t zero like a traditional policy, but achieves a $17,192 balance or nearly 90% of the $20,000 pay-in. This design is much closer to a BOLI or COLI than a traditional whole life insurance policy.

By copying policy design strategies of the wealthy or corporations, we copy their cash value growth performance to the extent possible. Once the whole life insurance policy reaches cash value equity in the fourth year, we get liquid access to funds a decade faster than the 14-15 years in a traditional one.

So, if you see, or have seen, a whole life insurance presentation that takes 14 years to breakeven then it’s either a traditional version or an agent that really needs to take our policy design training program. If you seek second and third opinions on cash value life insurance, you’re more likely to find an agent that understands the importance of policy design in cash value growth optimization.

Flexible Tax-Free Cash Value Growth

Maximum cash value whole life insurance policies are flexible tax-free savings vehicles. Cash value funds can be used in emergency situations, used as tax-free loans, and act as an annuity during your retirement years. It can be particularly useful for those who’ve maxed their IRA and 401k limits by providing a safe, stable, tax-free investment.

If you’d like more information on how to use a whole life insurance policy to maximize your tax-free cash position, you can view instructional videos on the IBC Global YouTube channel. You can also contact us for a free, no-obligation consultation from one of our Innovative Life Insurance Specialists.

Disclaimer

IBC Global Inc is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.

.png)